november child tax credit late

IR-2021-211 October 29 2021 WASHINGTON On Monday November 1 the Internal Revenue Service will launch a new feature allowing any family receiving monthly Child. But in the meantime dont forget that midterm election day 2022 is November 8 and early voting is available in most.

When Is The Next Child Tax Credit Check Coming Kare11 Com

Your first thought may be to contact the IRS but theres limited live assistance due to the tax return backlog delayed stimulus checks and unemployment tax refunds.

. The rest will come at tax time next year. Congress didnt pass tax extenders last year. SOME families who signed up late to child tax credits will receive up to 900 per child this month.

Those who miss the deadline can still claim the credit of up to 3600 per child if they file a 2021 tax return next year. The enhanced child tax credit which was created as part. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out of the monthly payments will receive 300 monthly.

The taxpayers that have eligible children under the age of 6 receive 300. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out of the monthly payments will receive 300 monthly. Generally this is 1800 per younger child and 1500 per older child the nonprofit explains.

Instructions on where to send it are at the bottom of the form. Right now they can only sign up online. The credit is 3600 annually for children under age 6 and.

The deadline to sign up for monthly Child Tax Credit payments is November 15. The administration previously said the credit would be a refund of approximately 13 of their 2021 state income tax liability. To start a trace complete Form 3911 and fax or mail it in.

Families can choose to file either in English or Spanish. To do so quickly and securely visit IRSgovchildtaxcredit2021. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out of the monthly payments will receive 300 monthly.

Change language content. If you believe that your income in 2020 means you were required to file taxes its not too late. The deadline is 1159 pm Eastern Time on Monday November 15.

Those who did not receive monthly payments in 2021 can file a tax return to get their. The credit is 3600 annually for children under age 6 and 3000 for children ages 6 to 17Eligible families who did not opt-out of the monthly payments will receive 300 monthly. The fifth installment of the advance portion of the Child Tax Credit CTC payment is set to hit bank accounts today November 15.

The Internal Revenue Service will soon start sending out the advanced payments of the child tax credit for November. He advanced Child Tax Credit payments are due out on the 15th day of each month over the second half of 2021 meaning that November 15 was the latest payment day. Thats just an estimate however -- it wont be finalized.

Families signing up now will normally receive. This is the second to last payment of the. In addition to.

1 day agoChild Tax Credit. The payments go out on the 15th of each month except on weekends so the November payment will come Monday.

Tax Deductions Credits Affected In 2019 By Inflation Don T Mess With Taxes

Child Tax Credit Was A Lifeline To My Special Needs Sons Time

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

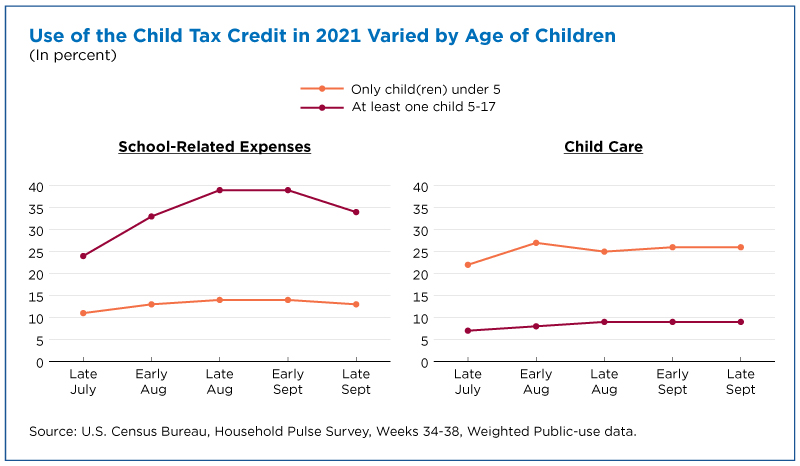

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

What To Do If You Still Haven T Received Your Child Tax Credit Payment Forbes Advisor

Signing Up Late For The Child Tax Credit Means Fewer Larger Checks

More Than 12 Billion In Lihtc Provisions And Nearly 6 Billion For Neighborhood Homes Tax Credits In Nov 3 Draft Of The Build Back Better Reconciliation Bill Would Finance Close To 1

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

Child Tax Credit Payments What To Expect In 2022 And How Much Nbc New York

Child Tax Credit Update Eyewitness News

How Does The Earned Income Tax Credit Affect Poor Families Tax Policy Center

Deadline To Opt Out Of September Child Tax Credit Payment Is Monday Here S How To Cancel It Fingerlakes1 Com

I Got My Refund Https Www Irs Gov Newsroom Child Tax Cr Facebook

When Is My November Child Tax Credit Coming Irs Payments King5 Com

When Is My November Child Tax Credit Coming Irs Payments King5 Com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

November Deadline For Child Tax Credit Payment Just Two Days Away Before Next Round Of Cash Sent Out The Us Sun

Child Tax Credit Delayed How To Track Your November Payment Marca

Irs Gives Taxpayers One Day To Rightsize Child Tax Credit November Payments November 1